Cochin Shipyard Limited (CSL), India’s leading shipbuilder and repair company, is a key PSU driving defense and maritime growth.

Renowned for building INS Vikrant, CSL boasts a ₹22,000 crore order book and a focus on ship repair and green vessels. What are CSL’s share price targets for 2025–2030? As of April 17, 2025, the stock trades at ₹1,444.20, down 47.33% from its July 2024 peak but up 715.48% over three years.

Despite a 27.58% profit drop in Q3 FY25, CSL’s 20.4% revenue growth and government support signal strong potential. Amid India’s PSU rally and global shipping challenges, we project share prices of cochin shipyard.

| Year | Share Price Target |

| Cochin Shipyard Share Price Target 2025 | ₹1,800–₹2,500 |

| Cochin Shipyard Share Price Target 2026 | ₹2,400–₹3,200 |

| Cochin Shipyard Share Price Target 2027 | ₹3,000–₹4,200 |

| Cochin Shipyard Share Price Target 2028 | ₹3,800–₹5,200 |

| Cochin Shipyard Share Price Target 2029 | ₹4,500–₹6,000 |

| Cochin Shipyard Share Price Target 2030 | ₹5,000–₹6,500 |

Let’s understand why we predict these share prices.

Current Financial Performance of Cochin Shipyard (As of Q3 FY25, December 2024)

CSL’s financial performance in FY24 and the first three quarters of FY25 reflects both strengths and challenges, providing insights into its growth trajectory.

Cochin Shipyard 2025 Revenue

For Q3 FY25 (ended December 2024), CSL reported consolidated net sales of ₹1,147.64 crore, a 4.74% year-on-year (YoY) increase from ₹1,069.88 crore in Q3 FY24.

However, revenue declined sequentially by 4% from ₹1,194 crore in Q2 FY25. For the nine months of FY25 (9M FY25), revenue from operations grew 20.4% YoY to ₹3,062.31 crore, driven by strong ship repair activities.

In FY24, CSL achieved a 56.4% revenue increase to ₹3,645 crore, highlighting its ability to capitalize on new contracts and export orders.

Profitability

CSL’s net profit for Q3 FY25 was ₹176.99 crore, down 27.58% YoY from ₹244.37 crore in Q3 FY24 and 6.31% sequentially from ₹188.92 crore in Q2 FY25. For 9M FY25, net profit rose 3% YoY to ₹540.15 crore.

The decline in quarterly profits is attributed to higher raw material costs, increased depreciation from new facilities, and a shift toward lower-margin contracts.

FY24 saw a 143.8% surge in profit before tax, reflecting robust operational performance.

Cochin Shipyard Order Book

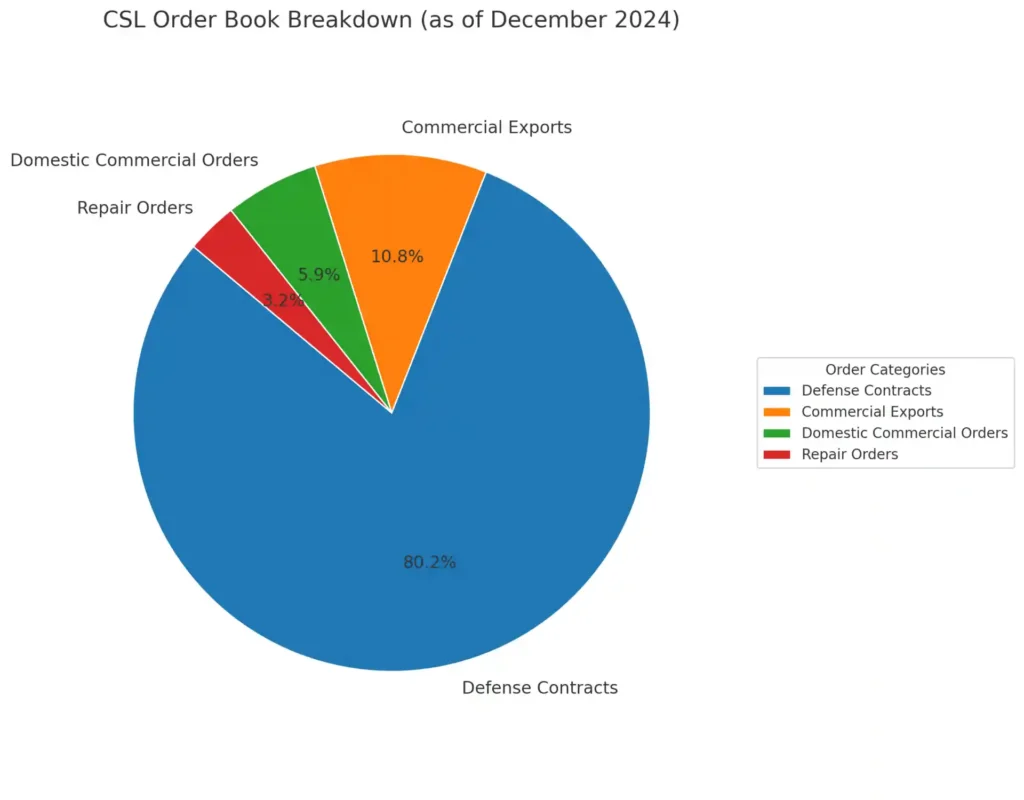

As of December 2024, CSL’s order book stands at approximately ₹22,000 crore, equivalent to 5–6 times its trailing 12-month revenue of ₹4,348.36 crore.

The order book comprises 82% defense contracts, 11% commercial exports, and 6% domestic commercial orders, with an additional ₹700 crore in repair orders.

Key contracts include orders from European clients like Pelagic Wind (₹1,050 crore) and collaborations with global firms like Fincantieri (Italy) and A.P. Moller–Maersk.

Financial Health

CSL remains nearly debt-free, with a strong balance sheet and stable cash flows. The company’s return on equity (ROE) for FY24 was 17.21%, and it maintained a pre-tax margin of 28%.

However, the stock trades at a high price-to-book (P/B) ratio of 7.37, indicating a premium valuation compared to historical averages.

The price-to-earnings (P/E) ratio as of April 11, 2025, is 46.11, reflecting investor confidence but also potential overvaluation risks.

Cochin Shipyard Dividends

CSL has a consistent dividend policy, with a second interim dividend of ₹3.50 per share declared for FY25 (record date: February 12, 2025).

The FY24 dividend totaled ₹9.80 per share, yielding 0.8% at the current price of ₹1,444.20 (as of April 16, 2025).

Cochin Shipyard Segment Performance

In Q3 FY25, shipbuilding revenue was ₹647.40 crore (down 14% YoY), while ship repair revenue surged 64.93% YoY to ₹500.24 crore, reflecting a strategic shift toward higher-margin repair activities. The new International Ship Repair Facility (ISRF) is expected to further boost repair revenue.

Current Indian Stock Market Scenario (April 2025)

The Indian stock market, as of April 2025, is experiencing cautious optimism amid global uncertainties.

The BSE Sensex and Nifty 50 have rallied in early 2025, driven by gains in banking, IT, and PSU stocks, but volatility persists due to global economic concerns.

Market Trends

The Sensex and Nifty opened higher in April 2025, supported by positive cues from Asian markets and domestic policy continuity. PSU and defense stocks, including CSL, have benefited from the government’s “Atmanirbhar Bharat” and “Make in India” initiatives, which prioritize indigenous manufacturing and defense procurement. However, midcap and smallcap stocks, including CSL, face pressure from high valuations and profit-taking.

Sector Performance

The defense and shipbuilding sectors are in focus due to increased government spending on naval modernization and infrastructure.

Stocks like Mazagon Dock, Garden Reach Shipbuilders (GRSE), and CSL have seen significant investor interest, though valuations have cooled from their 2024 peaks.

CSL’s 3-year return of 715.48% far outpaces the Nifty 100 (31.03%) and BSE Capital Goods (107%), but recent consolidation suggests a correction phase.

Challenges

Rising raw material costs (steel, copper, paint) and global supply chain disruptions pose risks to margins.

Additionally, foreign institutional investor (FII) outflows, which dropped to 2.91% in CSL by December 2024, could pressure midcap stocks. Mutual fund holdings, however, increased to 3.67%, indicating domestic investor confidence.

Global Market Situation and Its Impact on CSL

The global economic environment in April 2025 is mixed, with implications for CSL’s operations and stock performance.

Global Economy

The U.S. and European economies face slowdown risks, with inflation moderating but interest rates remaining elevated.

China’s economic recovery is uneven, impacting global shipping demand. Geopolitical tensions, including ongoing tariff trade wars, have led to a decline in defense stock valuations globally, affecting sentiment for CSL.

Shipping and Shipbuilding

Global demand for new ships is subdued due to economic uncertainty, but CSL benefits from niche markets like green vessels (e.g., electric-hybrid ferries) and defense contracts.

The company has exported 45 ships, strengthening its global position. However, competition from Chinese and South Korean shipyards, which offer lower costs, remains a challenge.

CSL’s MoU with Drydocks World and partnerships with European firms enhance its competitiveness in repair and green vessel segments.

Environmental Regulations

Stricter global emissions and sustainability regulations are increasing compliance costs for shipbuilders.

CSL’s investments in alternative fuel vessels (e.g., electric ferries for the Water Metro project) position it well for future demand but require significant capital expenditure, potentially straining short-term profitability.

How Current Market Conditions Affect Cochin Shipyard

CSL’s performance is closely tied to domestic and global market dynamics, with both opportunities and risks shaping its outlook.

Positive Factors:

Government Support: The Indian government’s focus on defense self-reliance ensures a steady flow of naval contracts. CSL’s role in building indigenous aircraft carriers and patrol vessels aligns with national priorities.

Ship Repair Growth: The high-margin ship repair segment, bolstered by the new ISRF, is a key growth driver. Repair revenue’s 64.93% YoY growth in Q3 FY25 highlights this potential.

Export Orders: CSL’s international contracts, such as the ₹1,050 crore order from Pelagic Wind and collaborations with Fincantieri, diversify revenue streams and mitigate domestic market risks.

Infrastructure Investments: Upgrades like the ISRF and new dry-dock facilities (60% complete as of FY22) enhance capacity and competitiveness.

Challenges:

Margin Pressure: Rising raw material costs and longer execution cycles for defense projects are squeezing margins. The 27.58% YoY profit decline in Q3 FY25 reflects these pressures.

Valuation Concerns: CSL’s high P/E (46.11) and P/B (7.37) ratios suggest limited upside in the near term unless earnings growth accelerates. The stock is 47.33% below its all-time high of ₹2,977.10 (July 2024), indicating a bearish trend.

Global Competition: Intense competition from global shipyards, especially in commercial shipbuilding, could erode market share.

Market Volatility: FII outflows and global economic uncertainty may lead to short-term stock price fluctuations, particularly for midcap PSUs like CSL.

Impact on Future Growth

CSL’s future growth will depend on its ability to leverage its strong order book, capitalize on government support, and navigate global challenges. Key factors include:

- Defense Sector Opportunities: With 82% of its order book from defense, CSL is well-positioned to benefit from India’s naval modernization. Potential contracts for additional aircraft carriers and frigates could drive revenue growth over the next 5–7 years.

- Ship Repair Expansion: The ISRF and collaborations with global firms like A.P. Moller–Maersk will boost repair revenue, which offers higher margins than shipbuilding. This segment could contribute significantly to profitability by 2030.

- Green Vessel Market: CSL’s focus on sustainable vessels, such as electric-hybrid ferries, aligns with global demand for eco-friendly shipping. The delivery of 18 out of 23 ferries for the Water Metro project underscores this capability.

- Financial Stability: CSL’s debt-free status and strong cash flows provide flexibility for capital investments and dividend payouts, supporting long-term investor confidence.

- Risks: Margin pressures from raw material costs, delays in project execution, and global competition could hinder earnings growth. Regulatory changes and environmental compliance costs may also impact profitability.

Cochin Shipyard Share Price Target: 2025–2030

| Year | Share Price Target |

| Cochin Shipyard Share Price Target 2025 | ₹1,800–₹2,500 |

| Cochin Shipyard Share Price Target 2026 | ₹2,400–₹3,200 |

| Cochin Shipyard Share Price Target 2027 | ₹3,000–₹4,200 |

| Cochin Shipyard Share Price Target 2028 | ₹3,800–₹5,200 |

| Cochin Shipyard Share Price Target 2029 | ₹4,500–₹6,000 |

| Cochin Shipyard Share Price Target 2030 | ₹5,000–₹6,500 |

Cochin Shipyard Share Price Target 2025: ₹2,150 (Range: ₹1,800–₹2,500)

CSL’s 3-year return of 715.48% reflects strong investor confidence. The stock rallied from ₹954.35 (52-week low) to ₹2,979.45 (July 2024 high) but corrected 47.33% by April 2025, trading at ₹1,444.20. Historical volatility (beta: 1.17) supports a potential 25–40% rebound.

Current Scenario: Q3 FY25 revenue growth (4.74% YoY) and a ₹22,000 crore order book ensure visibility. Ship repair’s 64.93% YoY growth offsets shipbuilding declines. However, a 27.58% YoY profit drop due to raw material costs (steel, copper) limits near-term upside.

Market Scenario: Indian PSU stocks benefit from defense spending, but FII outflows and global slowdowns cap gains. Technical indicators (50-day MA: ₹1,538.70) suggest a breakout above ₹1,530 could target ₹1,961.

Future Plans: The International Ship Repair Facility (ISRF) and new dry-dock (60% complete) will boost capacity. Export orders (e.g., ₹1,050 crore from Pelagic Wind) and MoUs with Fincantieri enhance revenue.

Upside: 25–40% from ₹1,444.20, driven by order execution and repair revenue.

Cochin Shipyard Share Price Target 2026: ₹2,800 (Range: ₹2,400–₹3,200)

Historical Data: CSL’s FY24 revenue grew 56.4%, with profit before tax up 143.8%. The stock’s 5-year CAGR of 35% supports sustained growth. Post-2025 correction, 2026 could see renewed momentum.

Current Scenario: 9M FY25 revenue growth of 20.4% and a debt-free balance sheet provide stability. Margin pressures (Q3 FY25 profit down 27.58%) may ease as raw material costs stabilize and repair revenue scales.

Market Scenario: India’s defense budget is projected to rise 10% annually, boosting CSL’s naval contracts. Global demand for green vessels grows, aligning with CSL’s electric-hybrid ferry projects. FII sentiment may improve with global recovery.

Future Plans: ISRF operations will ramp up, targeting ₹1,000 crore annually in repair revenue. Delivery of Water Metro ferries (18/23 completed) and European contracts will drive exports.

Upside: 30–40% from 2025 target, assuming 15% revenue CAGR and margin recovery.

Cochin Shipyard Share Price Target 2027: ₹3,600 (Range: ₹3,000–₹4,200)

Historical Data: CSL’s order book grew from ₹10,000 crore (FY20) to ₹22,000 crore (FY25), reflecting execution capability. The stock’s 10-year return of 1,200% underscores long-term potential.

Current Scenario: Defense orders (82% of book) ensure 5–7 years of revenue visibility. Ship repair’s high margins (20–25%) versus shipbuilding (10–15%) will improve profitability as ISRF scales.

Market Scenario: Indian midcaps may consolidate in 2027 post-2026 rallies, but CSL’s PSU status and defense focus insulate it. Global ship repair demand grows 5% annually, per industry reports, favoring CSL’s niche.

Future Plans: Potential contracts for additional aircraft carriers and frigates could add ₹5,000–₹10,000 crore to the order book. Partnerships with A.P. Moller–Maersk for green vessels enhance global competitiveness.

Upside: 25–30% from 2026, driven by defense and repair growth.

Cochin Shipyard Share Price Target 2028: ₹4,500 (Range: ₹3,800–₹5,200)

Historical Data: CSL’s FY24 ROE of 17.21% and consistent dividends (₹9.80/share in FY24) reflect financial discipline. The stock’s resilience during past market corrections supports steady growth.

Current Scenario: By 2028, CSL’s new dry-dock will be fully operational, doubling shipbuilding capacity. Repair revenue could reach ₹1,500 crore annually, per analyst estimates.

Market Scenario: India’s naval modernization and global green vessel demand (projected 7% CAGR) drive growth. Global economic stabilization may boost FII inflows, supporting midcap rallies.

Future Plans: CSL’s focus on alternative fuel vessels and international repair contracts will diversify revenue.

Upside: 20–25% from 2027, assuming 15% earnings CAGR and global recovery.

Cochin Shipyard Share Price Target 2029: ₹5,200 (Range: ₹4,500–₹6,000)

Historical Data: CSL’s revenue CAGR of 15% (FY20–FY24) and order book growth underpin long-term potential. The stock’s P/E ratio may normalize to 30–35 by 2029 as earnings grow.

Current Scenario: Sustained defense spending and repair revenue will stabilize margins. CSL’s debt-free status supports capital investments without diluting equity.

Market Scenario: Indian markets are expected to mature, with PSUs like CSL benefiting from policy continuity. Global shipbuilding demand may rise with economic recovery, though competition persists.

Future Plans: CSL aims to capture 10% of India’s ship repair market (₹5,000 crore by 2030). New contracts for offshore vessels and green ferries will boost exports.

Upside: 15–20% from 2028, driven by steady earnings and market confidence.

Cochin Shipyard Share Price Target 2030: ₹5,815 (Range: ₹5,000–₹6,500)

Upside: 10–15% from 2029, reflecting mature growth and market leadership.

Historical Data: CSL’s 10-year revenue CAGR of 12% and order book expansion to ₹22,000 crore support a 15% earnings CAGR through 2030. The stock’s long-term outperformance (1,200% in 10 years) justifies optimism.

Current Scenario: By 2030, CSL’s repair and green vessel segments will contribute 40–50% of revenue, per analyst projections. Defense contracts ensure stable cash flows.

Market Scenario: India’s defense budget may exceed ₹10 lakh crore by 2030, favoring CSL. Global demand for sustainable shipping (10% CAGR) aligns with CSL’s strategy. Midcap valuations may stabilize, boosting investor interest.

Future Plans: CSL’s goal to be a global repair hub and leader in green vessels will drive growth. Potential IPO of its subsidiary, Hooghly Cochin Shipyard, could unlock value.

Also Read

- avantel share price target 2023, 2024,2025, 2026, 2027, 2028, 2029, 2030

- Mazagon dock share price target 2023, 2024,2025, 2026, 2027, 2028, 2029, 2030

- BEL share price target 2023, 2024, 2025, 2026, 2027, 2028, 2029,2030

Cochin Shipyard Share Price Target 2040 and 2050:

2040 Target: ₹12,000–₹15,000

2050 Target: ₹25,000–₹30,000

Rationale: These long-term projections assume CSL maintains its leadership in India’s shipbuilding and repair sectors, capitalizes on global demand for green vessels, and benefits from India’s growing defense budget. A 15% CAGR in earnings, supported by infrastructure upgrades and international partnerships, could drive significant value creation. However, these targets are speculative and depend on macroeconomic stability, technological advancements, and CSL’s ability to counter global competition.

Technical Analysis and Market Sentiment

- Current Stock Price: As of April 16, 2025, CSL’s share price is ₹1,444.20, up 2.97% from the previous close of ₹1,401.00. The stock has fluctuated between a 52-week high of ₹2,979.45 and a low of ₹954.35, reflecting high volatility (beta: 1.17).

- Technical Indicators: The stock is trading above its 50-day moving average (₹1,538.70) but below its 200-day moving average (₹1,657.50), indicating a neutral to bearish trend. A breakout above ₹1,520–₹1,530 could signal bullish momentum, with targets at ₹1,600–₹1,961. Support lies at ₹1,275 (0.618 Fibonacci level).

- Market Sentiment: Posts on X highlight positive sentiment for CSL, with investors noting its attractive valuation and government support. Technical analysts suggest an accumulation phase, with potential for a rectangular box pattern breakout. However, high valuations and recent profit declines temper short-term enthusiasm.

Risks to Consider

Investors should be aware of the following risks:

- Margin Compression: Rising input costs and longer execution cycles for defense projects could pressure profitability.

- Global Competition: Chinese and South Korean shipyards pose a threat to CSL’s commercial shipbuilding market share.

- Market Volatility: FII outflows and global economic uncertainty may lead to price corrections in midcap stocks.

- Regulatory Costs: Stricter environmental regulations could increase compliance expenses, impacting short-term earnings.

Conclusion

Cochin Shipyard Limited is poised for strong growth through 2030, driven by its ₹22,000 crore order book, government support, and focus on high-margin ship repair and green vessels. Despite near-term challenges like margin pressures and high valuations, CSL’s debt-free balance sheet and strategic initiatives ensure long-term value creation. Investors should hold for long-term gains, accumulate on dips below ₹1,300, and monitor breakouts above ₹1,530 for short-term trades.

Yearly Share Price Targets:

- 2025: ₹2,150 (₹1,800–₹2,500)

- 2026: ₹2,800 (₹2,400–₹3,200)

- 2027: ₹3,600 (₹3,000–₹4,200)

- 2028: ₹4,500 (₹3,800–₹5,200)

- 2029: ₹5,200 (₹4,500–₹6,000)

- 2030: ₹5,815 (₹5,000–₹6,500)

Recommendation: Consult a financial advisor before investing. Stock markets carry inherent risks, and past performance does not guarantee future results.

Hi, I’m Ashish, the author here. With a solid background in data analytics and statistics, I bring you straightforward insights into the stock market. I research stocks inside out, blending fundamental and technical analyses. My goal is to provide you with clear, actionable content that simplifies the complexities of investing. Join me on this journey for straightforward advice and a data-driven approach to making informed decisions in the stock market.