Hey, investor! Wondering if Tata Motors is your next big bet? As India’s auto giant, Tata Motors powers everything from zippy Nexons to heavy-duty trucks and premium Jaguar Land Rover (JLR) SUVs.

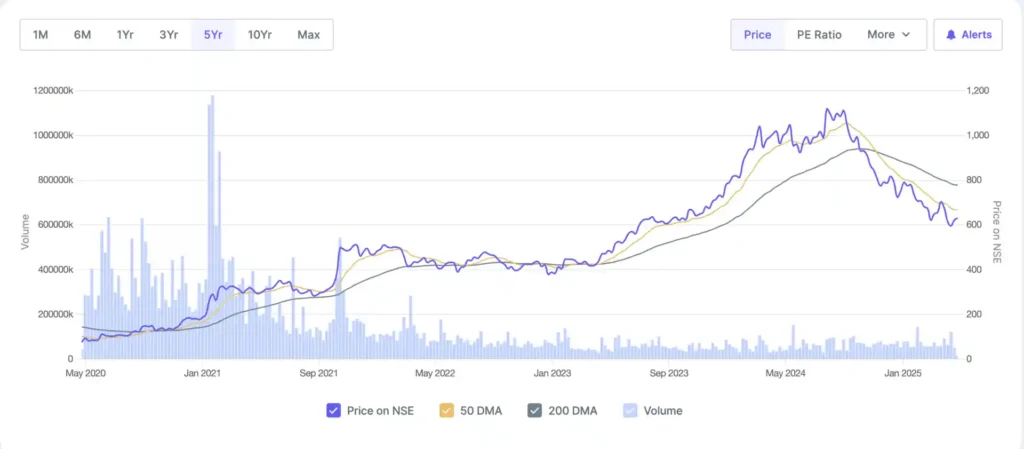

With its bold electric vehicle (EV) push, it’s a stock that’s hard to ignore. As of April 20, 2025, Tata Motors’ share price is ₹621.55, down 47.33% from its 52-week high of ₹1,179.05 but up 15.97% from its low of ₹535.75.

So, what’s driving this stock, and what are the share price targets for 2025 to 2030? Let’s explore Tata Motors’ financials, market trends, and why we predict these prices.

What’s Happening with Tata Motors in April 2025?

Tata Motors is a heavyweight with a market cap of ₹228,814 crore. In FY24, it posted ₹438,000 crore in revenue (up 26.6% from ₹346,000 crore in FY23) and a profit of ₹31,807 crore, a massive turnaround from years of losses.

But Q3 FY25 (ended December 2024) showed cracks: revenue was ₹115,000 crore (below the expected ₹118,000 crore), and earnings per share (EPS) hit ₹14.80, missing estimates of ₹17.38.

Net income rose 63.06% quarter-on-quarter to ₹5,451 crore, but margins shrank due to negative operating leverage.

JLR, contributing 70% of revenue, saw record sales in India but a 5.1% global retail sales drop (108,232 units in Q4 FY25).

The commercial vehicles (CV) segment shone, with 376,903 units sold in FY25, beating industry trends, while passenger vehicle (PV) sales dipped 6% to 146,999 units in Q4 FY25.

Tata Motors achieved JLR’s net debt zero target in FY25, boosting its balance sheet, but high operating costs (9.7% for employee expenses) and a volatile return on equity (ROE, 36.97% in FY24) raise concerns.

Here’s a snapshot of Tata Motors’ current financials:

| Metric | Q3 FY25 (Dec 2024) | FY24 (Mar 2024) |

| Revenue (₹ crore) | 115,000 | 438,000 |

| Net Profit (₹ crore) | 5,451 | 31,807 |

| EPS (₹) | 14.80 | 83.07 |

| EBITDA Margin (%) | 13.2 | 14.3 |

| Net Debt (₹ crore) | 0 (JLR debt-free) | 15,000 (reduced) |

| Market Cap (₹ crore) | 228,814 | 228,814 |

| P/E Ratio | 7.2 | 7.2 |

| ROE (%) | – | 36.97 |

Tata Motors Share Price Targets: 2025–2030

Here’s our forecast for Tata Motors’ share price, based on financials, market trends, and analyst insights:

| Tata Motors Share Price Target Year | Price (₹) |

| 2025 | 850 |

| 2026 | 1,100 |

| 2027 | 1,400 |

| 2028 | 1,800 |

| 2029 | 2,200 |

| 2030 | 2,600 |

What’s the Indian Stock Market Like?

India’s market is buzzing in April 2025. The Sensex and Nifty are up, fueled by metal stocks and PSUs, but FII outflows and profit-taking are causing swings.

The auto sector’s Nifty Auto index has delivered 101.35% over three years, outpacing Tata Motors’ 46.26%. SUVs (55% market share) and CNG vehicles (35% growth) are hot, and EVs are the future, but Tata Motors’ EV market share slipped to 38% as Hyundai and Mahindra gain ground.

Government infrastructure spending and lower crude oil prices are lifting CV demand, a win for Tata Motors.

How’s the Global Market Impacting Tata Motors?

Globally, it’s a bumpy ride. A potential 25% US import tariff, flagged by President Trump, threatens JLR, which gets 14.4% of its Q4 FY25 wholesale volumes from the US. This triggered a 6% share price drop and a CLSA downgrade to ₹735.

Europe’s 10.9% volume growth is a plus, but China’s 29.4% drop stings. The global EV market is growing (10% CAGR), but economic slowdowns and supply chain issues loom.

Tata Motors’ $1.5 billion battery gigafactory and plans to double EV charging points by 2027 position it well for the green shift.

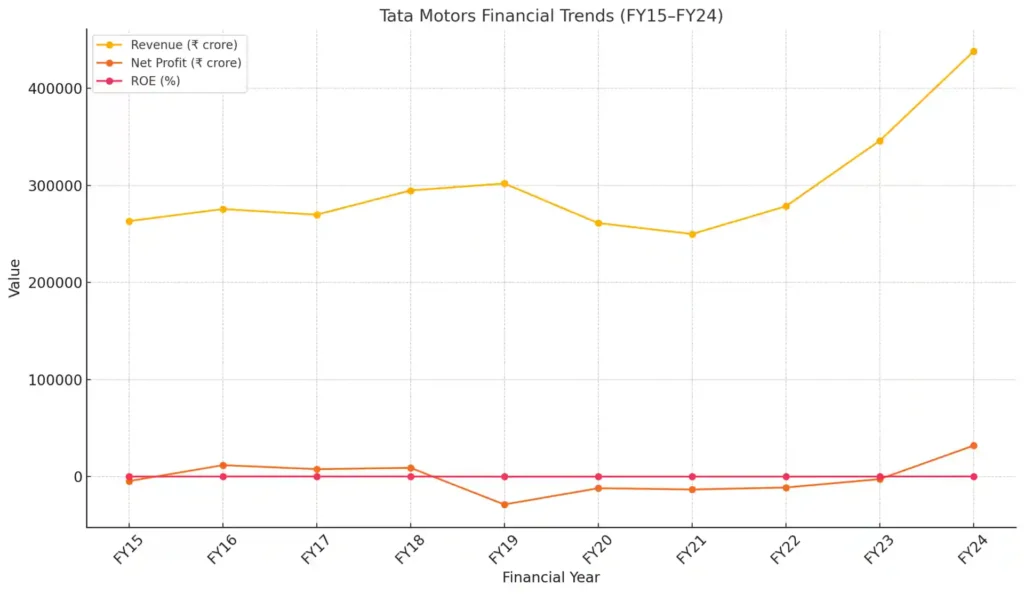

Last Ten Years’ Balance Sheet: What Does It Tell Us?

To understand Tata Motors’ future, let’s look at its financial journey from FY15 to FY24. The balance sheet shows how the company battled losses, slashed debt, and pivoted to EVs, shaping our price predictions.

| Year | Revenue (₹ crore) | Net Profit (₹ crore) | Total Assets (₹ crore) | Total Debt (₹ crore) | Equity (₹ crore) | ROE (%) |

| FY15 | 263,159 | -4,739 | 218,616 | 73,078 | 15,912 | -29.80 |

| FY16 | 275,561 | 11,678 | 257,107 | 68,595 | 28,575 | 40.85 |

| FY17 | 269,693 | 7,557 | 273,754 | 78,138 | 29,337 | 25.76 |

| FY18 | 294,664 | 8,989 | 331,123 | 88,951 | 37,354 | 24.07 |

| FY19 | 301,938 | -28,826 | 306,857 | 99,903 | 18,639 | -154.64 |

| FY20 | 261,068 | -12,071 | 314,673 | 114,741 | 19,273 | -62.63 |

| FY21 | 249,795 | -13,395 | 336,326 | 124,038 | 23,297 | -57.50 |

| FY22 | 278,454 | -11,308 | 330,931 | 122,356 | 21,054 | -53.71 |

| FY23 | 346,000 | -2,690 | 359,695 | 77,000 | 34,000 | -7.91 |

| FY24 | 438,000 | 31,807 | 369,521 | 15,000 | 86,000 | 36.97 |

Key Insights from the Balance Sheet

- Revenue Growth: Revenue grew from ₹263,159 crore (FY15) to ₹438,000 crore (FY24), a 66.4% increase, with a CAGR of ~5.8%. Growth was uneven, dipping in FY20–FY21 due to COVID-19 and JLR’s slowdown, but FY24’s 26.6% jump reflects strong CV and PV demand.

- Profitability Swings: Tata Motors faced losses in FY15 (₹-4,739 crore), FY19 (₹-28,826 crore), and FY20–FY22, driven by JLR’s struggles and high debt costs. The FY24 profit of ₹31,807 crore, fueled by JLR’s recovery and CV sales, marks a turnaround.

- Debt Reduction: Debt peaked at ₹124,038 crore (FY21) but fell to ₹15,000 crore (FY24), with JLR achieving net debt zero. This strengthens Tata Motors’ ability to fund EV investments, boosting investor confidence.

- Asset Growth: Total assets rose 68.9% from ₹218,616 crore (FY15) to ₹369,521 crore (FY24), reflecting investments in manufacturing and EV tech.

- Equity and ROE: Equity grew from ₹15,912 crore (FY15) to ₹86,000 crore (FY24), but ROE was volatile, swinging from -154.64% (FY19) to 36.97% (FY24). Recent ROE stability supports higher valuations.

Impact on Tata Motors Share Price Target 2025-2030

- Debt Reduction and Profit Recovery: The shift from heavy losses (FY19–FY22) to a ₹31,807 crore profit (FY24) and near-zero debt signals financial health, supporting our 2025–2026 targets (₹850–₹1,100). Investors reward deleveraging, as seen in Emkay’s bullish outlook.

- Revenue Growth: A 5.8% CAGR and FY24’s 26.6% surge underpin our 10–15% revenue CAGR assumption for 2027–2030, driving targets like ₹2,600 (2030).

- JLR’s Volatility: Past losses (e.g., FY19) from JLR’s China slowdown mirror current risks (29.4% volume drop), capping near-term upside (2025: ₹850).

- Asset Investments: Growing assets (₹369,521 crore) and EV spending ($1.5 billion gigafactory) justify long-term targets (2028–2030: ₹1,800–₹2,600), as they enhance production capacity.

Tata Motors Share Price Targets 2025: ₹850 (Range: ₹625–₹1,099)

Tata Motors is undervalued at a P/E of 7.2 (vs. Maruti Suzuki’s 25.6). Analysts’ median target is ₹816.17, with highs at ₹1,099 and lows at ₹625.

We predict ₹850, driven by CV growth (376,903 units in FY25) and EV launches (e.g., Curvv SUV). JLR’s India sales and debt-free status are boosts, but US tariffs and a 38% EV market share drop limit gains.

Tata Motors Share Price Targets 2026: ₹1,100 (Range: ₹900–₹1,300)

The 2024 demerger into CV and PV entities will streamline operations, lifting margins. The $1.5 billion gigafactory and doubled charging points will fuel EV sales, with India’s EV market growing 66% annually.

JLR’s premium models (66.3% of Q4 FY25 volumes) and Europe’s 10.9% growth add momentum. China’s slowdown and tariff risks persist, but a 10% revenue CAGR supports ₹1,100.

Tata Motors Share Price Targets 2027: ₹1,400 (Range: ₹1,200–₹1,600)

New EV models (e.g., Harrier EV) and government green policies will reclaim market share. Lower interest rates and infrastructure spending will drive CV and PV demand.

JLR’s high-margin Range Rover and Defender (67.8% of FY25 volumes) will boost profits. Assuming stable global demand, ₹1,400 is realistic, though geopolitical risks could lower it to ₹1,200.

Tata Motors Share Price Targets 2028: ₹1,800 (Range: ₹1,500–₹2,100)

Tata Motors’ global EV push and new manufacturing hubs (India, UK, South Africa) will shine. CVs will grow with India’s logistics boom, and JLR’s Mauritius expansion and EV platforms will add revenue.

A 12% earnings CAGR and global recovery support ₹1,800, but competition from Tesla and BYD could cap gains.

Tata Motors Share Price Targets 2029: ₹2,200 (Range: ₹1,900–₹2,500)

By 2029, Tata Motors’ EV leadership and tech advancements (battery recycling, automation) will lift margins.

India’s 8% annual auto market growth and Tata Motors’ 14.1% PV share will expand with new launches.

JLR’s luxury EVs will tap global demand, supporting ₹2,200, though margin pressures from competitors could hit the lower range.

Tata Motors Share Price Targets 2030: ₹2,600 (Range: ₹2,300–₹3,000)

Tata Motors could be an EV powerhouse by 2030, leveraging its ₹369,521 crore assets and engineering edge.

CVs will benefit from India’s logistics growth, and JLR’s luxury EVs will drive profits. A 15% revenue CAGR and stable markets point to ₹2,600, but tariff wars or slowdowns could pull it to ₹2,300.

Recent News Outlines: What’s Shaping Tata Motors?

- US Tariff Threat (April 2025): A potential 25% US import tariff sparked a 6% share price drop, with CLSA downgrading to ₹735. JLR’s 14.4% US volumes are at risk, impacting near-term sentiment.

- JLR’s India Success (March 2025): JLR reported record India sales in FY25, boosting revenue despite a 5.1% global retail dip. Premium models like Range Rover led growth.

- EV Market Share Loss (February 2025): Tata Motors’ EV share fell to 38% as Hyundai and Mahindra launched competitive models, per industry reports.

- Demerger Progress (January 2025): The 2024 demerger into CV and PV units is set to enhance focus and valuation, with completion expected by mid-2025.

- Battery Gigafactory (December 2024): Tata Motors announced a $1.5 billion investment in a UK-based gigafactory, targeting 40 GWh capacity by 2027, a key EV growth driver.

- CV Sales Surge (November 2024): Tata Motors sold 376,903 CV units in FY25, outpacing peers, thanks to infrastructure demand and lower oil prices.

Risks to Keep in Mind

Tata Motors faces some hurdles:

- US Tariffs: A 25% tariff could cut JLR’s US sales, a major profit driver.

- EV Competition: Losing ground to Hyundai and Mahindra could erode margins.

- Global Slowdown: China’s 29.4% volume drop and economic headwinds may hurt earnings.

- Stock Volatility: A beta of 1.39 means bigger swings than the market.

- Execution Risks: Delays in EV launches or gigafactory rollout could stall growth.

Conclusion: Should You Invest in Tata Motors?

Tata Motors is a stock with huge potential but real challenges. Its EV ambitions, CV strength, and JLR’s luxury appeal make it a compelling pick, especially at a low P/E of 7.2.

India’s auto boom and government support are tailwinds, but global tariffs and competition are speed bumps. Our targets—₹850 in 2025 to ₹2,600 in 2030—reflect Tata Motors’ growth story, backed by a stronger balance sheet and EV investments.

Before jumping in, check the financials, follow X sentiment, and talk to a financial advisor. Are you bullish or bearish on Tata Motors? Drop your thoughts in the comments!

Hi, I’m Ashish, the author here. With a solid background in data analytics and statistics, I bring you straightforward insights into the stock market. I research stocks inside out, blending fundamental and technical analyses. My goal is to provide you with clear, actionable content that simplifies the complexities of investing. Join me on this journey for straightforward advice and a data-driven approach to making informed decisions in the stock market.